- Why Should You Use This Calculator?

- What Makes This Calculator Special

- How to Use the Calculator Step by Step

- How to Get Better Results

- Understanding What Exness Calculator Shows You

- Using Exness Calculator for Risk Control

- Comparing Different Trading Situations

- Frequently Asked Questions About Exness Calculator

Why Should You Use This Calculator?

This trading calculator from Exness platform is a must-have tool. It does the math for you before you place any trades. You get calculations for things like margin requirements, how much each pip is worth, and what you might gain or lose. This makes planning your trades much simpler. Any trader who wants to be smart about their decisions should use this calculator. It saves time and gives you correct numbers, which helps lower your trading risks.

What Makes This Calculator Special

The Exness calculator comes with many useful features. Let me tell you about the main ones:

- Complete calculation options: The tool looks at many different things like what type of account you have, which instruments you want to trade, how big your trade size is, and your leverage level. All this helps give you the right answers.

- Easy to use: The design is simple. Anyone can figure it out quickly, whether you just started trading or you’ve been doing it for years.

- Quick answers: You get your results right away. This includes how much profit you might make, what margin you need, pip values, and swap costs.

- Help with risk control: You can see how risky each trade might be and plan ways to keep your losses small.

- Settings you can change: You can adjust the inputs to match how you like to trade and what you need.

Calculation Variables

To get the right results, you need to know what numbers the calculator uses. Here are the important ones:

- Your Exness account type: Different accounts work differently. Knowing which type you have helps the calculator give you better results.

- What you’re trading: This could be currency pairs, gold, oil, or other things you can trade.

- Trade size: This is how big your trade is. It changes both your margin needs and how much you might win or lose.

- Leverage amount: This is how much money you can borrow to trade with. More leverage can mean more risk.

- Buy and sell prices: These are the current prices where you can buy or sell what you’re trading.

How to Use the Calculator Step by Step

Using this calculator is easy and helps you make better trading choices. Here’s how to do it right.

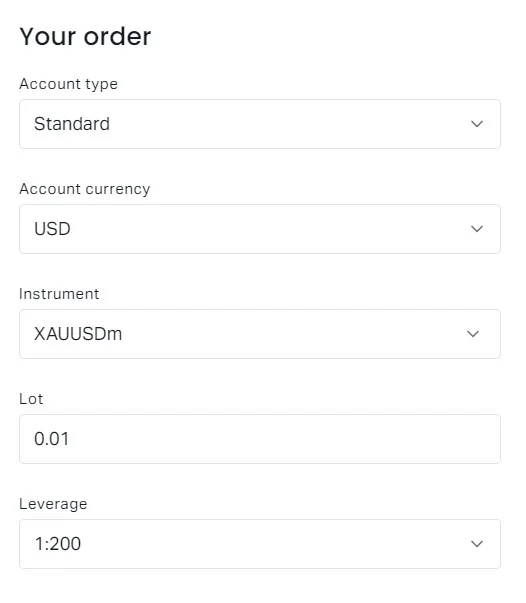

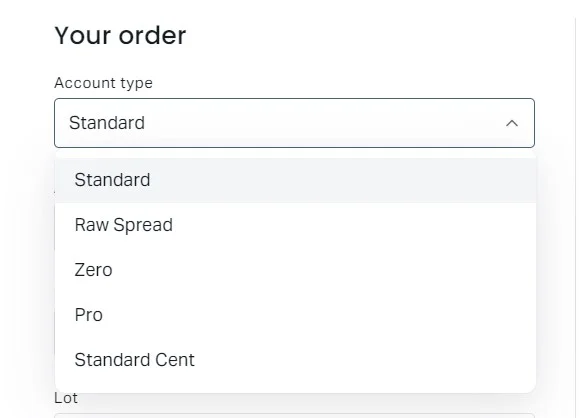

Pick Your Account Type

Start by choosing which account you have. Exness gives you several choices like Standard, Pro, Raw Spread, and Zero accounts. Each type has different rules for things like spreads and fees. Getting this right is very important. If you have a Raw Spread account, make sure you select it so the calculator gives you numbers that match your real trading situation.

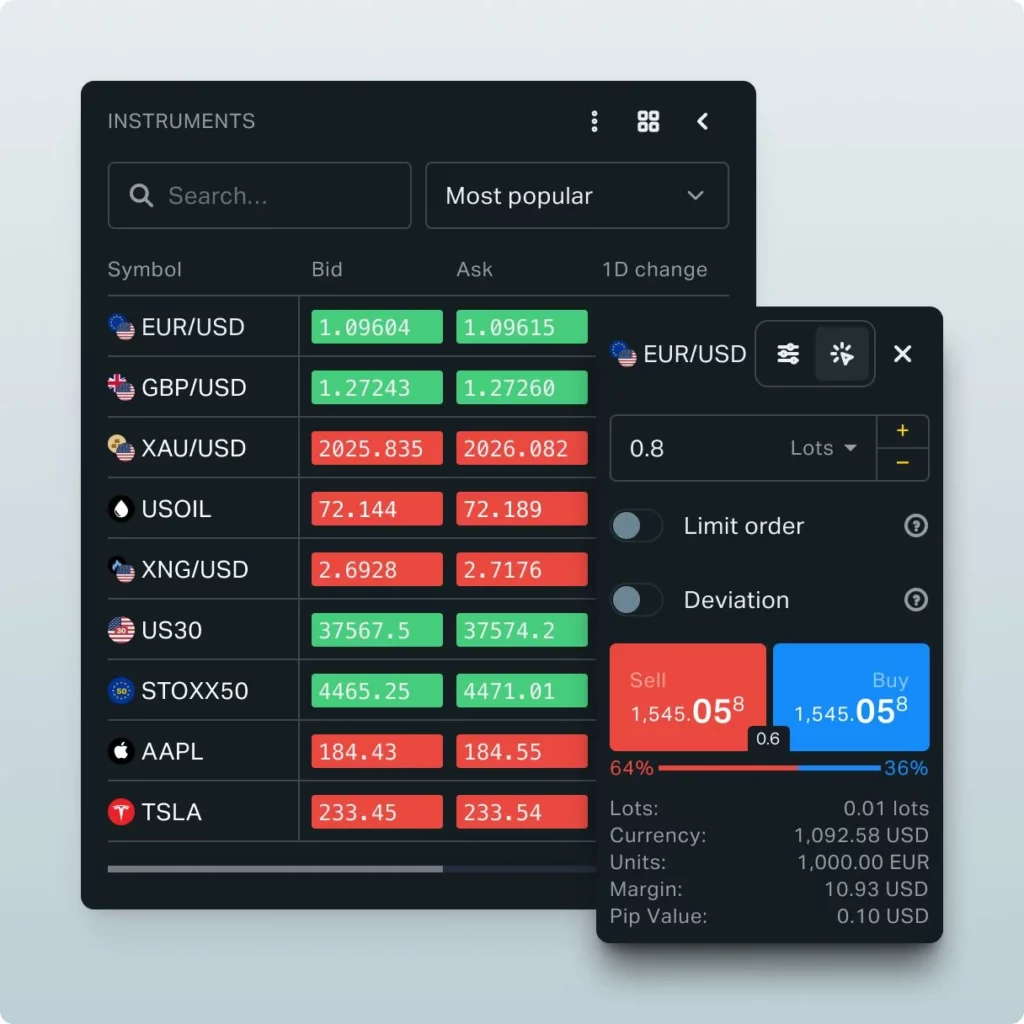

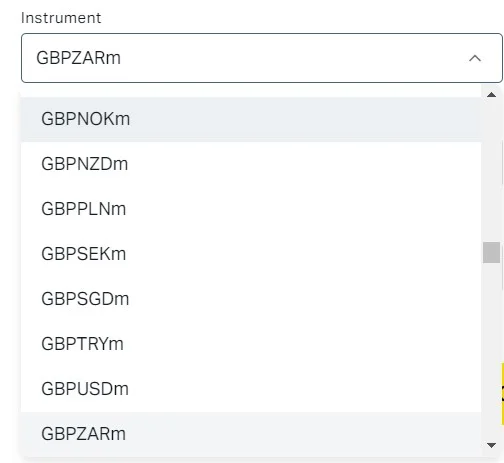

Choose What to Trade and How Much

Next, pick what you want to trade and how big you want your trade to be. This calculator works with many different things you can trade. You can choose currency pairs like EUR/USD, metals like gold, or even cryptocurrencies like Bitcoin. After you pick what to trade, put in how many lots you plan to trade. Let’s say you want to trade 0.5 lots of gold – you would type “0.5” in the lot size box.

Set Your Leverage

Pick the leverage you want to use. This should match what your trading account allows. For example, if your account lets you use 1:200 leverage, put that number in the leverage box. The leverage you choose will change how much margin you need and how much you might make or lose from trading.

Get Your Results

After you fill in everything, click the “Calculate” button to see your results. The calculator will show you important information like how much margin you need, what each pip is worth, and what you might gain or lose. For example, if you trade 1 lot of EUR/USD with 200 times leverage, you might need $500 as margin to open the position. It also shows pip value, which tells you how much you make or lose when the market moves by one pip.

How to Get Better Results

To get the most out of this calculator, follow these tips:

- Double-check what you enter: Always make sure you put in the right account type, trading instrument, lot size, and leverage before you calculate. Small mistakes can give you wrong results.

- Use current prices: When you do your calculations, use the latest market prices to stay up to date. Markets change fast, so fresh data is very important.

- Learn what each setting does: Understanding how each number affects your calculations helps you make better trading decisions.

- Use real numbers: Put in numbers that match your actual trading plan and goals. Don’t use extreme numbers that don’t represent how you really trade.

- Study your results: Look carefully at what the calculator tells you. Check if things like potential profit and margin match what you expect from your strategy.

Understanding What Exness Calculator Shows You

When you use this calculator, you get important details about your trade. Here’s what each result means:

Margin

Margin is the money you need to put up front. It’s a small part of your total trade size. When you use leverage, the calculator figures out how much margin you need based on your account type and trade size. This helps you know how much money you need to set aside for the trade.

Spread Cost

Spread cost is the difference between buy and sell prices. Think of it as a trading fee. Every trade has spread costs, and the calculator shows you this cost so you understand what it will cost to make a specific trade.

Commission

Commission is a fee some brokers charge for each trade. The calculator tells you if there are commission fees and how much they are. This helps you understand the total cost of your trading.

Overnight Fees (Long and Short Positions)

Overnight fees are interest charges when you keep positions open after the market closes. Long swap is for buy trades, and short swap is for sell trades. The calculator shows these rates so you know if you’ll pay or receive interest when holding positions overnight.

Pip Value

Pip value is how much you make or lose for each pip the price moves. The calculator works this out based on your trade size and what you’re trading. Knowing pip value helps you understand your potential profits and losses.

Using Exness Calculator for Risk Control

This trading calculator is great for managing your trading risks. It shows you what might happen before you make a trade. Here’s how it helps:

- Plan better trades: You can try different settings and see how changes affect your trades. This helps you plan more carefully.

- Set stop loss and take profit: The calculator helps you figure out good levels to limit losses and lock in profits. This protects your money better.

- Understand risk vs reward: It helps you decide if a trade is worth making based on possible risks and rewards. This leads to smarter and safer trading.

Comparing Different Trading Situations

It’s important to understand how different trading choices affect your results. The calculator lets you compare various situations.

Let’s say you’re trading EUR/USD but with different leverage and trade sizes:

| Trading Details | First Example | Second Example |

| Currency Pair | EUR/USD | EUR/USD |

| Trade Size | 1 lot | 0.5 lot |

| Leverage | 1:100 | 1:500 |

| Account Type | Standard Account | Pro Account |

| Margin Required | $1,000 | $100 |

| Value Per Pip | $10 per pip | $5 per pip |

| Profit/Loss for 10-pip move | $100 | $50 |

Looking at the Differences

In the first situation, you trade 1 lot of EUR/USD on a Standard account with 1:100 leverage. You need $1,000 as margin, and each pip movement is worth $10. This means when the market moves 10 pips, you make or lose $100.

In the second situation, you trade 0.5 lot of EUR/USD on a Pro account with higher 1:500 leverage. Here, you only need $100 as margin, and each pip is worth $5. So when the market moves 10 pips, you make or lose $50.

What This Means

These examples show how leverage and trade size affect your trading results. Higher leverage means you need less margin. Smaller trades mean less profit but also less risk. By changing these settings, you can use the calculator to see results from different trading scenarios, which helps you trade smarter.

Frequently Asked Questions About Exness Calculator

How do I calculate margin with Exness calculator?

Simply put in your Exness account type, the trading instrument you want, your trade size, and leverage level. The Exness calculator will show you exactly how much margin you need for this specific trade.