Capital.com has emerged as a preferred choice for cost-conscious traders in Hong Kong who seek access to global markets through an intuitive, AI-supported trading platform. With its zero-commission CFD trading model and an expansive educational ecosystem, Capital.com bridges the gap between technology, financial literacy, and accessibility.

Zero Commissions and Competitive Spreads

One of Capital.com’s strongest value propositions is its 0% commission policy, which allows traders to enter and exit CFD positions without incurring traditional brokerage fees. For Hong Kong traders managing diversified portfolios or executing frequent trades, this structure significantly reduces the overall cost of trading.

Capital.com instead generates revenue through tight spreads, which are highly competitive compared to traditional brokerages. This pricing model is particularly attractive for intraday and swing traders in Hong Kong who are sensitive to transaction costs.

Access to Thousands of CFDs

Capital.com offers CFD trading across more than 3,000 financial instruments, including:

- Stocks (US, UK, EU, Asia)

- Forex

- Commodities

- Indices

- Cryptocurrencies

This breadth of asset classes supports portfolio diversification, which is especially important for traders in Hong Kong who seek exposure beyond the local market, such as US tech stocks or European energy commodities.

AI-Powered Behavioral Insights

Capital.com integrates AI analytics to monitor trader behavior and help users mitigate common cognitive biases such as loss aversion or overtrading. For instance, if a trader consistently opens high-risk trades or deviates from risk management strategies, the system provides personalized nudges and insights.

This feature aligns well with the risk-conscious mindset of many Hong Kong traders, who often operate within strict capital preservation rules or use disciplined strategies.

Educational Emphasis and Regulatory Transparency

Capital.com places a strong focus on financial education, offering:

- Interactive courses

- Market explainers

- Video tutorials

- Glossaries and trading guides

Its learning hub is designed for traders at all levels and is particularly useful for beginners in Hong Kong who may be entering CFD markets for the first time.

Additionally, the platform is regulated by the Financial Conduct Authority (FCA), CySEC, and ASIC, and operates under a model of full transparency. Although it doesn’t hold a Type 1 license under the Hong Kong SFC (as of current knowledge), its offshore access remains compliant for retail traders using foreign-regulated entities.

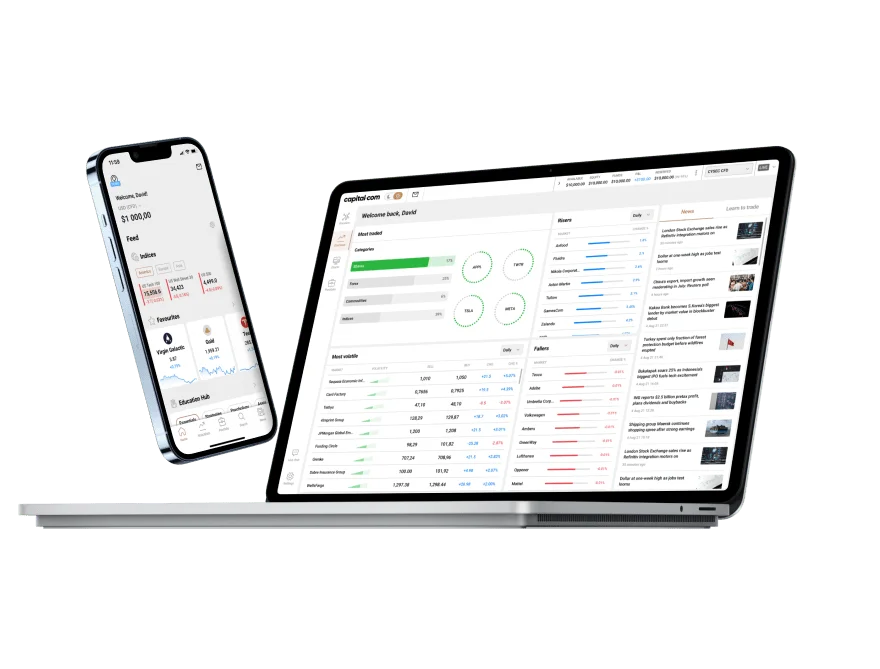

Real-Time Newsfeed and Analytical Tools

Capital.com integrates a real-time newsfeed that delivers market updates, economic events, and sentiment analysis — a key advantage for traders in fast-moving Asian sessions.

Other core tools include:

- Economic calendars

- Integrated TradingView charts

- Price alerts

- Custom watchlists

These features help Hong Kong traders make decisions during volatile hours and track international markets while synchronizing with their local trading schedule.

Multi-Device Access: Web and Mobile

Capital.com’s trading suite is accessible via:

- Web platform – clean, responsive interface ideal for desktop users

- Mobile app – fully featured, offering charting, alerts, and trading execution on the go

For Hong Kong’s increasingly mobile-first trading community, the seamless cross-platform experience ensures that users can manage trades anywhere — from Central’s MTR to the comfort of home.

Who Is It Best For?

Capital.com is best suited for:

- Cost-sensitive traders who prioritize zero-commission and tight spreads

- Hong Kong-based beginners seeking structured education in CFD trading

- Intermediate traders who want AI-powered feedback on their habits

- Globally focused investors looking to trade diverse assets beyond the Hang Seng Index