Charles Schwab is a U.S.-based brokerage firm with a long-standing reputation for wealth management, retirement planning, and portfolio diversification. While it does not hold a license from Hong Kong’s Securities and Futures Commission (SFC), the platform is widely used by local investors who seek global exposure and prefer managing their assets through a stable international institution.

Key Features and Advantages

- Commission-Free Trading: Schwab offers zero-commission trading on U.S. stocks and ETFs, making it cost-efficient for investors focused on American markets.

- Professional Research Resources: Clients gain access to in-depth research from trusted providers such as Morningstar and Credit Suisse, helping traders analyze companies, funds, and macroeconomic trends before making investment decisions.

- Schwab Global Account: This account type enables Hong Kong users to trade securities across multiple markets, including the U.S., Europe, and Asia, all from a single interface.

- Low Barriers to Entry: There are no account maintenance fees and low minimum deposit requirements, making the platform accessible to both new and experienced investors.

Suitability for Hong Kong Traders

Charles Schwab is particularly suited to long-term investors in Hong Kong who prioritize stability, transparency, and diversified asset allocation. The platform’s broad range of retirement and wealth management tools make it ideal for individuals planning for long-term financial security rather than short-term speculation.

Considerations for Hong Kong Users

While Schwab’s services are available remotely, users should note that:

- Transactions are governed by U.S. regulations.

- Currency conversions may apply when funding or withdrawing in HKD.

- Customer support and compliance procedures operate under U.S. jurisdiction.

Despite these factors, Charles Schwab remains a trusted option for global portfolio diversification, offering Hong Kong investors a secure gateway to U.S. markets and international investment opportunities.

Account Setup and Access for Hong Kong Residents

Although Charles Schwab is primarily a U.S.-based institution, it allows international clients, including those in Hong Kong, to open accounts remotely. The process is straightforward:

- Application Submission: Investors complete an online form for the Schwab One International Account or Schwab Global Account, providing proof of identity and address.

- Document Verification: Required documents typically include a valid Hong Kong ID or passport, proof of address (e.g., a utility bill), and tax-related forms (such as W-8BEN for U.S. non-residents).

- Funding the Account: Transfers can be made via international wire in major currencies. Schwab does not charge incoming wire fees, although sending banks may impose charges.

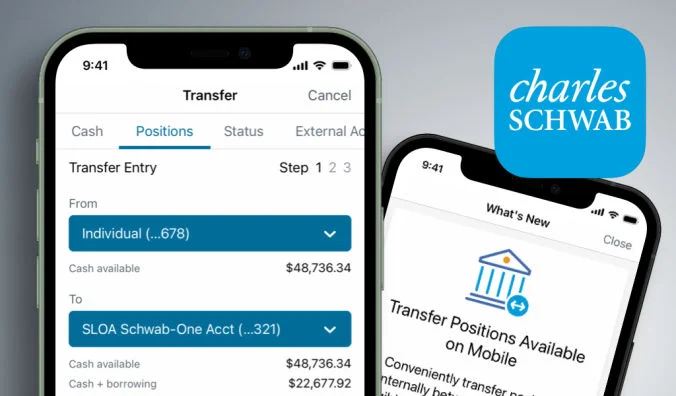

- Platform Access: Once approved, users can log in via Schwab.com or the Schwab Mobile App, gaining access to trading tools, research dashboards, and performance tracking.

This accessibility makes Schwab one of the few major U.S. brokers that provides a compliant and well-structured entry point for Hong Kong-based traders seeking cross-border investments.

Trading Tools and Technology

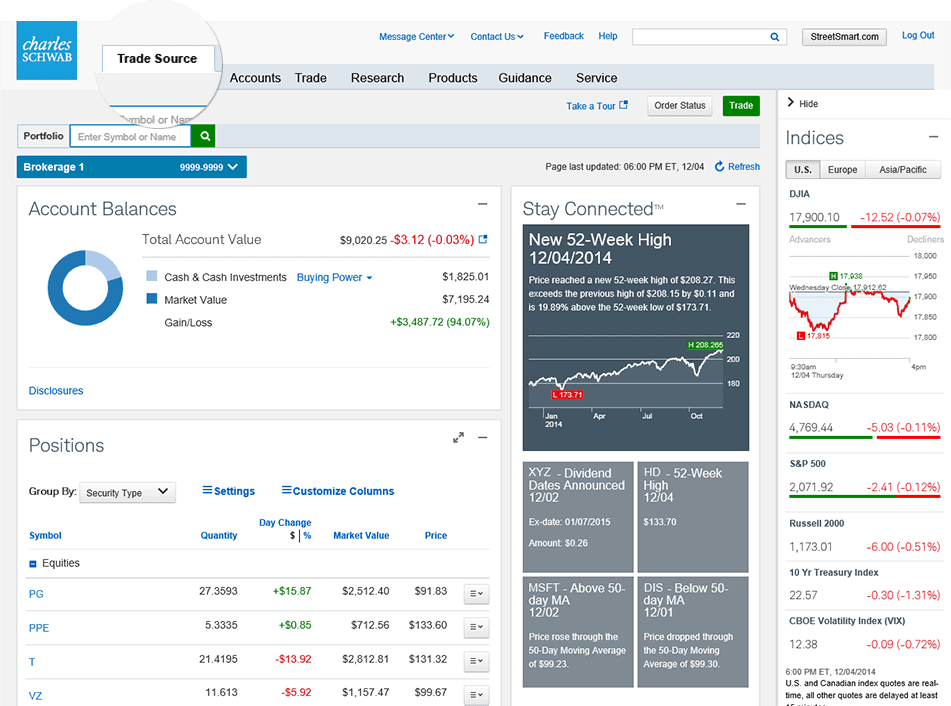

Charles Schwab’s infrastructure is known for its institutional-grade reliability and user-friendly interface. It provides:

- Schwab.com Trading Dashboard: Ideal for long-term investors, offering order management, research integration, and customizable watchlists.

- StreetSmart Edge: A desktop-based trading platform with advanced charting, technical indicators, and real-time market data — particularly useful for active traders.

- Mobile App: Allows full account monitoring and trade execution, with price alerts and balance summaries accessible on the go.

- Integration with Research Portals: Traders can access professional-grade insights from Morningstar, Credit Suisse, and Schwab Equity Ratings, allowing for informed, data-driven decision-making.

For Hong Kong users, these tools combine accessibility with professional quality, supporting both passive investors and active traders.