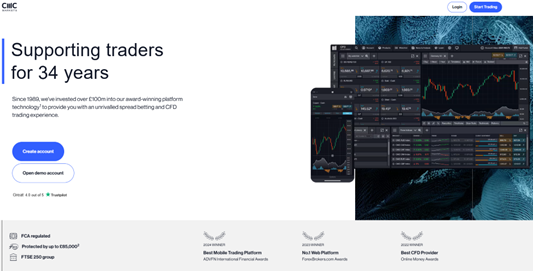

CMC Markets is a premier choice for traders in Hong Kong who demand high precision, regulatory confidence, and sophisticated trading capabilities. As one of the most established CFD providers globally, CMC Markets brings its international strength to the local market under the regulation of the Securities and Futures Commission (SFC). Its comprehensive Next Generation platform is built to serve the technical needs of active traders across asset classes.

Why CMC Markets Stands Out for Hong Kong Traders

Operating under SFC license no. AJI792, CMC Markets adheres to strict compliance measures, providing a secure environment that aligns with Hong Kong’s financial standards. This regulatory layer is vital for professional traders seeking both protection and legitimacy in CFD trading.

Diverse Asset Coverage

With over 12,000 tradable instruments, the platform allows users to diversify their portfolio across:

- Forex pairs, including HKD crosses

- Hong Kong and global equities

- Major indices, such as the Hang Seng Index

- Commodities, ETFs, and treasuries

This extensive reach supports multi-asset strategies that are crucial for navigating today’s dynamic markets.

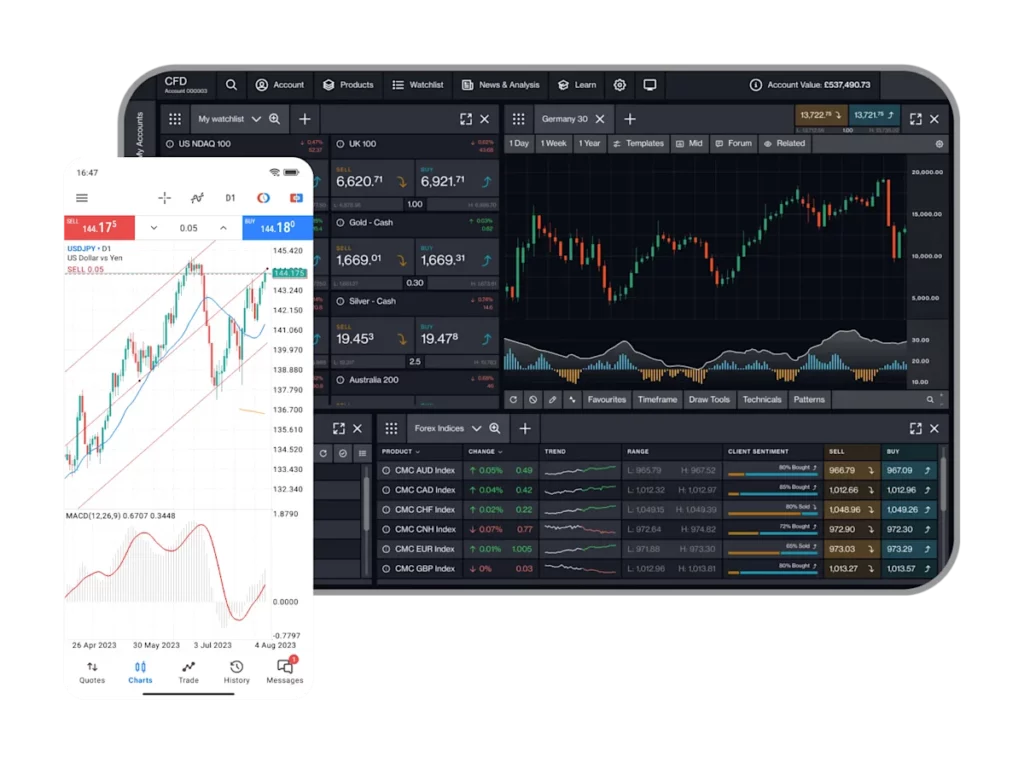

Key Features of the Next Generation Platform

Advanced Charting Tools

CMC’s charting suite includes over 80 technical indicators, drawing tools, and customizable templates. Traders can identify trends, validate setups, and backtest strategies in real time.

Pattern Recognition Scanner

The platform automatically scans for 16 popular chart patterns like head & shoulders, triangles, and wedges. Alerts are triggered in real-time, allowing for fast execution when opportunities emerge.

One-Click Trading with Price Ladders

Speed matters. CMC offers one-click order execution through an intuitive price ladder interface, enabling precise order placement during high-volatility scenarios.

Modular Workspace

Users can configure dashboards with watchlists, news feeds, trading charts, and order books—ideal for maintaining a real-time pulse on multiple instruments without tab-switching.

Risk Management Tools

Advanced order types include:

- Guaranteed Stop-Loss Orders (GSLOs)

- Trailing stops

- Boundary orders

These help traders manage downside risk, especially in volatile markets like forex and indices.

Platform Access & Integration:

- Web-based platform (no installation required)

- Native iOS and Android apps for mobile trading

- Integrated economic calendar and Reuters newsfeed

- API access for algorithmic and institutional traders (available upon request)

Tailored for Hong Kong Market Conditions

Hong Kong traders operate within a liquid, fast-paced environment, often requiring instant reaction to macroeconomic news, political shifts, or Asia-Pacific trading sessions. CMC Markets’ infrastructure supports low-latency execution and real-time pricing, critical for scalpers and intraday traders.

Moreover, being regulated in both Hong Kong (SFC) and the UK (FCA), CMC Markets caters to cross-border investors and those seeking a globally recognized, stable trading partner.