eToro has established itself as a premier global social trading platform, offering a unique experience that blends traditional trading with social interaction. For traders based in Hong Kong, eToro’s flexibility, multi-currency support (including HKD), and access to global markets make it a compelling choice.

CopyTrader™ Technology

eToro’s standout feature is its CopyTrader™ system, which allows users to automatically mirror the trades of experienced investors. This is ideal for beginners looking to learn by example or for busy professionals seeking a passive trading strategy.

- One-click copying of top-performing traders

- Performance stats and risk scores are fully transparent

- Ability to diversify by copying multiple traders

This feature is especially useful for Hong Kong traders entering global markets like crypto or US stocks without deep technical analysis skills.

Commission-Free Stock Trading

eToro enables zero-commission trading on stocks (excluding spreads and conversion fees):

- No broker fees on buying or selling stocks

- Access to over 3,000 stocks from major exchanges (NYSE, NASDAQ, LSE, HKEX)

- Fractional shares available – invest in high-value stocks with minimal capital

This model benefits retail investors in Hong Kong, who are increasingly looking for low-cost alternatives to traditional brokers.

Social Trading and Real-Time Market Sentiment

eToro integrates social media dynamics directly into its platform:

- A real-time social feed where traders discuss strategies, market news, and trends

- Market sentiment data derived from crowd behavior

- Option to comment, like, and follow other traders – creating a trading community

This is valuable for Hong Kong’s tech-savvy traders who rely on digital interaction and real-time data for decisions.

Multi-Currency Support & Localized Features

eToro supports HKD and USD, which is important for Hong Kong users to avoid excessive FX fees when trading international assets.

- Funds can be deposited via bank transfer, credit/debit cards, or e-wallets (PayPal, Skrill, etc.)

- Platform available in multiple languages, including Traditional Chinese

- Mobile app optimized for iOS and Android users in Asia-Pacific

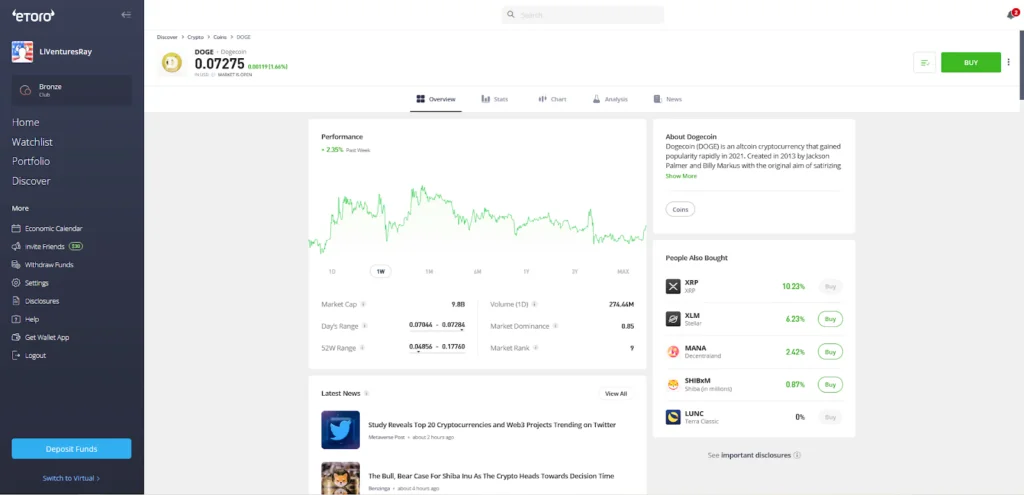

Wide Range of Tradable Instruments

While eToro is widely known for stocks and crypto, it also supports:

- Forex trading: 40+ currency pairs

- CFDs on indices, commodities, ETFs, and cryptocurrencies

- Crypto-to-crypto trading pairs

This versatility is ideal for Hong Kong traders looking to diversify across global markets while staying within one unified platform.

Who Is eToro Best For in Hong Kong?

| Profile | Why eToro is Suitable |

|---|---|

| Beginner Traders | CopyTrader™ allows easy learning by following pros |

| Crypto Enthusiasts | Direct access to dozens of cryptocurrencies |

| Global Investors | Access to international stocks & diversified assets |

| Part-Time Traders | Mobile app + passive strategies = flexible trading |

| Low-Cost Focused Investors | No commissions on stocks + minimal account fees |

Things to Consider Before Using eToro

While eToro offers a wide range of benefits, it’s important for traders in Hong Kong to be aware of several potential limitations and risks associated with the platform:

CFD Trading Involves High Risk

CFDs (Contracts for Difference) are leveraged instruments, meaning you can open larger positions than your actual balance. While this can amplify gains, it also increases the risk of losses, especially in volatile markets.

- Leverage risks: eToro allows leverage up to 30:1 depending on the asset and account type, which can wipe out your capital if not used properly.

- Margin calls: If your account falls below required margin levels, positions may be closed automatically.

- Not suitable for beginners without risk management strategies in place (stop-loss, take-profit).

Spread-Based Pricing

Although eToro promotes commission-free stock trading, it earns through spreads – the difference between the buy and sell price of an asset.

- Spreads vary depending on market volatility and liquidity.

- Some asset spreads (especially on cryptocurrencies or exotic forex pairs) can be relatively wide compared to other platforms.

- Hidden costs: Spread-based pricing can make short-term trading less cost-effective.

Limited Advanced Charting and Technical Tools

eToro’s platform is designed with ease of use in mind, which benefits casual and beginner investors. However, professional or highly technical traders may find the analytical tools somewhat limited.

- Basic charting interface with limited indicators (compared to platforms like MetaTrader 4/5 or TradingView).

- No option for custom indicators or algorithmic trading bots.

- Limited backtesting or multi-screen setup functionality.

Conversion Fees for Non-USD Deposits

While eToro supports multiple currencies, including HKD, all accounts are denominated in USD. This means:

- Deposits in HKD are automatically converted to USD, incurring a currency conversion fee (typically 0.5%-2.5% depending on method).

- Withdrawals in non-USD may also trigger similar fees.

- Some payment methods (like credit cards or PayPal) may include additional FX charges.

Limited Localized Support in Asia

Although eToro offers services to Hong Kong residents, their customer support and educational resources may not be as localized as some regional competitors.

- Customer service is mostly in English and primarily online (no dedicated Hong Kong office).

- Market news and insights are often global-focused, with limited emphasis on Asia-Pacific stocks or events.

- Some traders may find response times slower during Asia time zones.