Interactive Brokers is a global multi-asset brokerage firm that gives traders in Hong Kong direct access to over 160 markets, including the Hong Kong Stock Exchange (HKEX). Known for its professional-grade tools, transparent cost structure, and robust regulatory status, IBKR is a platform built for advanced trading needs rather than casual investing.

Regulatory Oversight in Hong Kong

IBKR operates in Hong Kong through Interactive Brokers Hong Kong Limited, fully licensed and regulated by the Securities and Futures Commission (SFC). This ensures client fund segregation, reporting transparency, and strict adherence to local financial conduct rules.

The platform is also regulated by top-tier global bodies, including:

- US SEC and FINRA

- UK FCA

- European regulators under IBKR entities in Ireland and Luxembourg

For traders based in Hong Kong, this level of compliance provides a high degree of trust and operational security.

Assets Available for Trading

Interactive Brokers supports one of the most diverse product selections in the industry. A single account allows access to the following:

- Hong Kong and international equities

- ETFs from global exchanges

- Options (single-leg and multi-leg strategies)

- Futures and futures options (including HKEX and CME)

- Forex with institutional spreads

- Government and corporate bonds

- Mutual funds, commodities, and metals

With its global infrastructure, IBKR is well-suited for building diversified, multi-market portfolios without needing multiple brokerage accounts.

Fee Structure and Minimum Deposit

IBKR offers two pricing models:

- Fixed pricing: Charges a flat rate per share or contract (e.g. $0.005/share for US stocks)

- Tiered pricing: Reduces costs based on trading volume and passes through exchange and clearing fees

In Hong Kong, typical fees on HKEX are:

- From 0.08% per trade, including government levies and platform fees

- No custody or platform maintenance charges

- Minimum deposit: None officially, but accounts under USD $2,000 may have limited features

For margin accounts, interest rates are highly competitive, often far lower than local banks or retail brokers.

Leverage and Margin Options

Interactive Brokers provides margin trading with transparent rate structures:

- Equities: Up to 1:4 (25% margin requirement)

- Forex: Up to 1:66 for major currency pairs

- Futures and options: Based on exchange requirements and account profile

Risk controls include real-time margin monitoring, automated liquidation warnings, and customizable alerts for exposure or drawdowns.

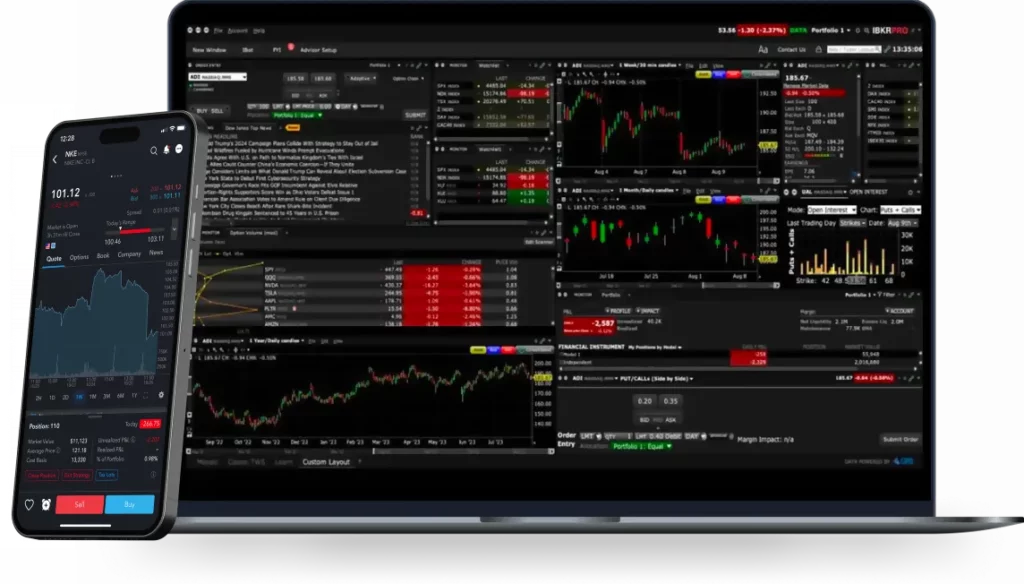

Trading Platforms

The core platform is Trader Workstation (TWS), a fully customizable and powerful terminal for professional trading:

- Advanced order types: bracket orders, trailing stops, OCO, conditional triggers

- Multi-screen support with drag-and-drop customization

- Integrated news feeds, real-time scanners, and API connectivity

- Full backtesting and automated trading modules

Other options include:

- Client Portal: A simplified web-based version for managing accounts and placing basic trades

- IBKR Mobile: Feature-rich mobile app with real-time data and charting

All platforms offer access to the same account and synced trading functionality.

Who Is IBKR Best For?

IBKR is not for beginners or casual users. It is best suited for:

- Professional traders who need execution speed, advanced orders, and global market access

- Asset managers and hedge funds operating across multiple jurisdictions

- Active day traders using options, futures, or forex strategies

- Long-term investors who require low-cost exposure to global ETFs and bonds

- Algo traders building or deploying automated strategies

Pros and Cons for Hong Kong Residents

| Pros | Cons |

|---|---|

| Regulated by SFC and compliant with local laws | Learning curve is steep for TWS |

| Direct access to HKEX and 160+ global exchanges | Platform complexity may overwhelm less experienced users |

| Transparent, low-cost commissions | Real-time market data requires a subscription |

| No inactivity or maintenance fees | High volume users benefit most from fee structure |

| Multi-asset coverage in one account | Limited local customer support hours during weekends/US hours |