OANDA has established itself as a reputable brokerage firm specializing in foreign exchange (forex) and contracts for difference (CFDs). It is especially appealing to currency traders in Hong Kong due to its strong regulatory foundation, competitive pricing structure, and support for high-frequency and algorithmic trading.

Why OANDA Is a Smart Choice for Hong Kong Traders

Traders in Hong Kong operate in one of Asia’s most dynamic financial hubs, where execution speed, regulatory clarity, and platform efficiency are essential. OANDA meets these standards by combining global reputation with features built for precision trading.

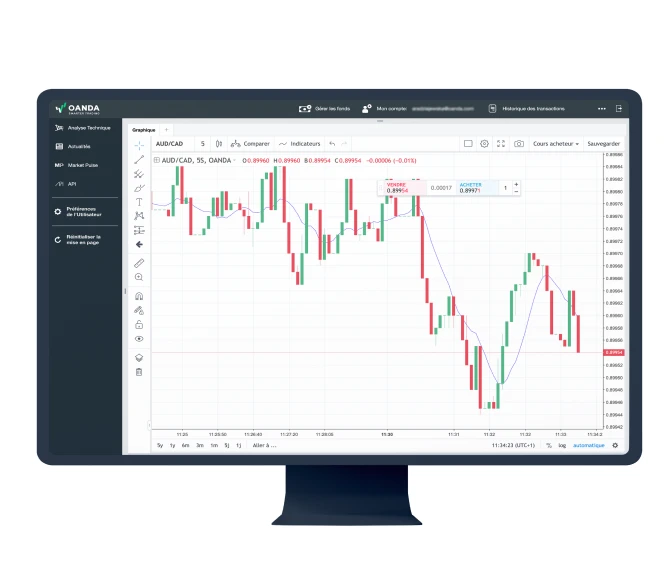

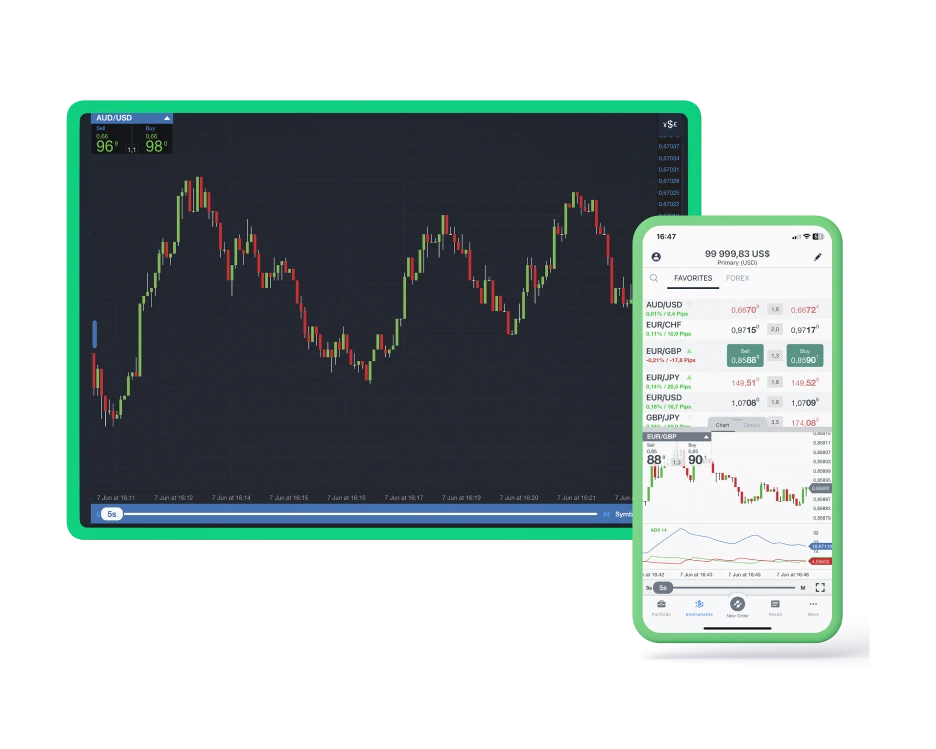

Advanced fxTrade Platform

OANDA’s proprietary trading interface, fxTrade, is engineered for responsiveness and data clarity. It provides:

- Lightning-fast order execution

- Real-time position and profit tracking

- Robust charting tools with multiple timeframes

- User-friendly interface for both desktop and mobile

For traders in Hong Kong trading during overlapping Asian and European sessions, fxTrade offers a stable and latency-optimized environment.

Access to 70+ Currency Pairs

Hong Kong-based traders benefit from OANDA’s wide selection of major, minor, and exotic forex pairs. This includes HKD crosses, such as USD/HKD and HKD/JPY, which are relevant to regional trading strategies.

API Access & MT4 Compatibility

OANDA supports REST and FIX APIs, allowing algorithmic traders and developers to build and test automated strategies with live data. For those using MetaTrader 4 (MT4), OANDA offers a seamless bridge, enabling the use of expert advisors (EAs), custom indicators, and scripts.

Real-Time Pricing Transparency

OANDA’s pricing engine aggregates rates from multiple liquidity providers. Real-time rate feeds are available on both platforms and APIs, ensuring that Hong Kong traders always see market-reflective prices.

Strong Regulatory Oversight

While OANDA operates under multiple licenses globally, including in the US and UK, its Asia-Pacific operations are regulated by the Monetary Authority of Singapore (MAS). This adds an extra layer of compliance and trust for clients in the broader Asia region.

Robust Risk Management Tools

Effective risk control is vital for Hong Kong traders facing high volatility in currency markets. OANDA offers:

- Guaranteed stop-loss orders (in eligible jurisdictions)

- Negative balance protection

- Customizable leverage controls

- Margin call alerts and automated liquidation features

These features allow traders to protect capital in fast-moving markets while maintaining exposure flexibility.

Education & Research Tailored to Asia-Pacific

OANDA provides a range of educational resources, webinars, and market insights designed for traders in Asia. This includes:

- Localized market outlooks (covering Asia sessions)

- Economic calendar with region-specific events

- Beginner to advanced trading tutorials

- Real-time news feeds integrated into the platform

For newer traders in Hong Kong, these tools can accelerate skill development and build disciplined trading habits.