Plus500 is a globally recognized CFD trading platform that caters exceptionally well to Hong Kong-based traders due to its SFC (Securities and Futures Commission) authorization, intuitive interface, and transparent fee structure.

Whether you are a beginner exploring CFD markets or a casual trader who values simplicity and regulatory safety, Plus500 offers a trading environment that checks all the boxes for efficiency and reliability.

Key Highlights for Hong Kong Users

SFC-Regulated for Local Trust

Plus500HK Ltd is fully licensed and regulated by the Securities and Futures Commission (SFC) in Hong Kong. This ensures:

- Full compliance with local financial laws

- Segregated client accounts

- Strong investor protection under Hong Kong regulations

Additionally, the platform is also licensed by:

- FCA (UK)

- CySEC (EU)

- ASIC (Australia)

- FMA (New Zealand)

This multi-jurisdictional regulatory backing makes Plus500 a globally trusted CFD broker with local relevance for Hong Kong residents.

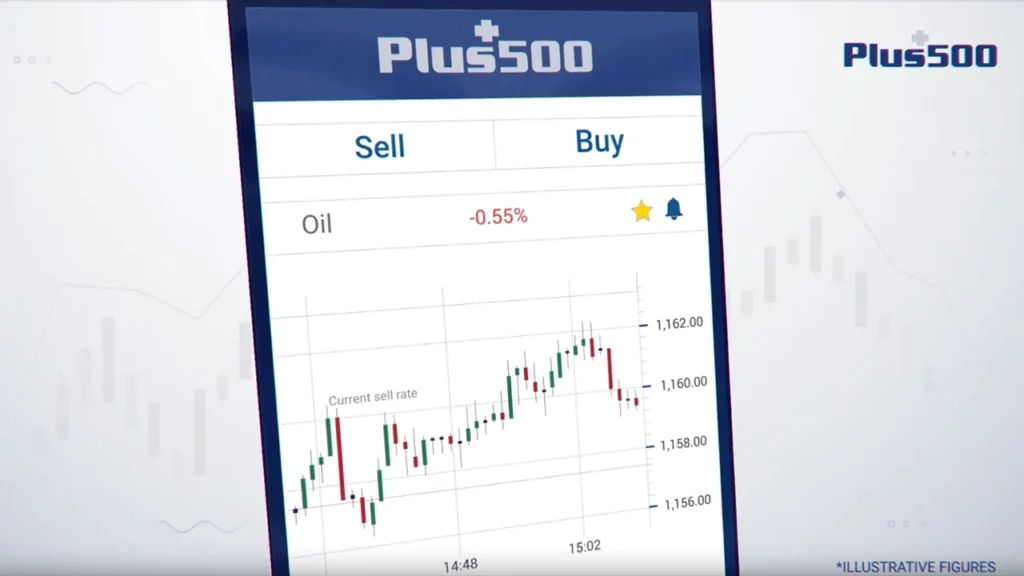

User-Friendly Web & Mobile Platforms

Plus500 is best known for its clean, distraction-free interface. Traders in Hong Kong who prefer speed, clarity, and easy access to financial instruments will find its design especially useful.

- One-click order execution

- Price alerts and notification tools

- Fully localized platform (including support for Traditional Chinese)

- Cross-device access (iOS, Android, desktop)

Wide Range of Tradable Assets

With access to over 2,800 instruments, Plus500 enables traders to explore:

- Hong Kong stocks (e.g. HSBC, China Mobile, CNOOC)

- Major & minor forex pairs

- Popular cryptocurrencies

- Global stock indices and ETFs

- Commodities (gold, oil, natural gas)

- Options and more

This diversity supports both speculative and hedging strategies in one platform.

Built-In Risk Management Tools

Plus500 provides advanced order types and features that are vital for managing risk in volatile CFD markets:

- Guaranteed Stop Loss Orders (GSLO)

- Trailing Stop

- Limit and Stop Orders

- Negative balance protection

Especially helpful for Hong Kong users trading during overlapping Asian/European market hours.

Commission-Free Model with Transparent Spreads

You pay no commission on trades. Instead, Plus500 earns through tight, variable spreads.

No hidden charges. No deposit/withdrawal fees. Full pricing transparency.

This is excellent for traders who want to maintain cost control and avoid unexpected broker fees.

Who Should Use Plus500 in Hong Kong?

Best suited for:

- New traders looking for an easy learning curve

- Investors seeking access to global and local markets

- Traders prioritizing regulatory safety and cost predictability

Less suitable for:

- Traders needing advanced technical analysis or algo trading

- Institutional-level traders or those requiring API access

Account Types and Minimum Deposit

Plus500 keeps things simple: only one standard live account for retail traders and a free demo account for practice.

- Minimum deposit: HK$1,000 (or equivalent)

- Funding methods: Bank transfer, Visa/Mastercard, PayPal, FPS

- Withdrawal time: 1–3 business days

No tiered account system—every client gets full platform access with no upselling of features.

Mobile Trading Experience for On-the-Go Users

In Hong Kong’s fast-paced lifestyle, mobile trading is critical. Plus500 offers a highly rated mobile app for both Android and iOS that includes:

- Full charting and order management

- Real-time push notifications

- Price alerts directly to your phone

- Fingerprint/Face ID login

The mobile app is synchronized with the desktop version, meaning you can switch between devices without losing session data.

Security, Support & Transparency

Hong Kong traders benefit from:

- Two-factor authentication (2FA)

- Data encryption and secure socket layers (SSL)

- Client fund segregation under SFC regulation

Plus500 also provides:

- Multilingual customer support, available 24/7 via live chat and email

- Transparent trading history and account reports

- Investor protection policies depending on jurisdiction

These measures help ensure the platform remains safe and legally compliant.