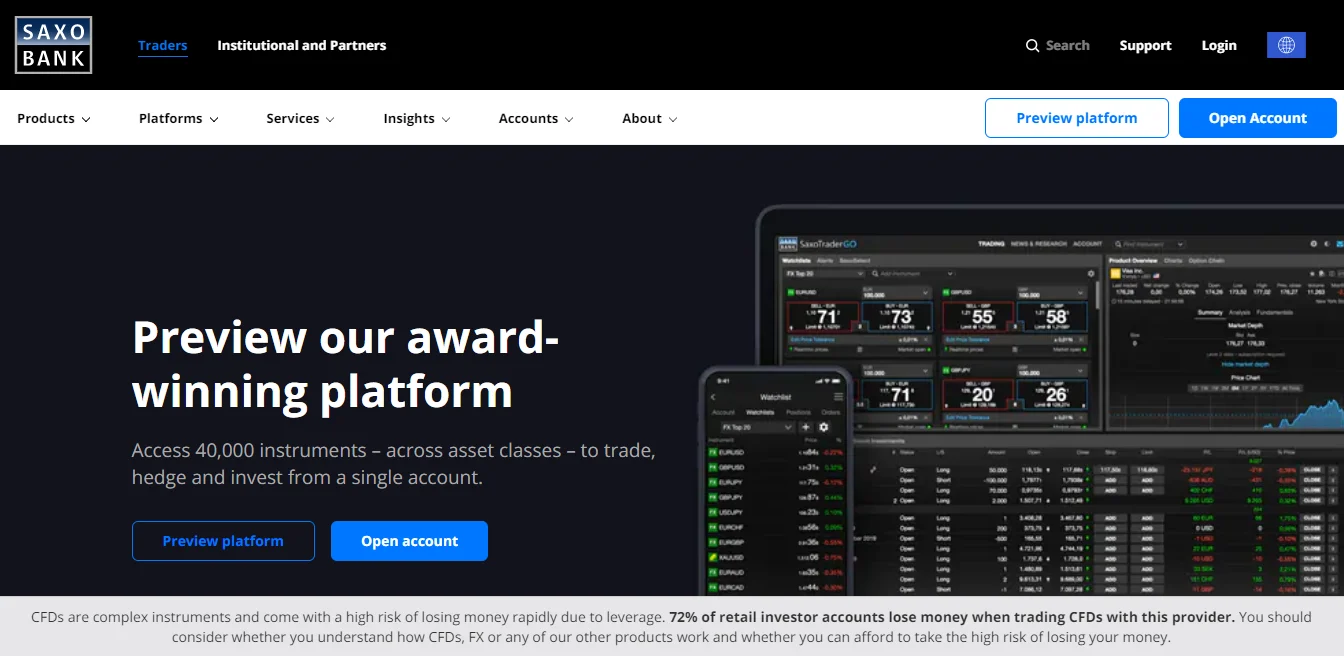

Saxo Bank positions itself as a high-end brokerage platform, offering access to a broad spectrum of financial instruments combined with institutional-level tools. For traders in Hong Kong who require precision, stability, and deep market access, Saxo provides a sophisticated environment built around reliability and execution efficiency.

Regulatory Standing and Local Licensing

In Hong Kong, Saxo Bank operates under Saxo Capital Markets HK Ltd., which is fully licensed and regulated by the Securities and Futures Commission (SFC). This local license ensures Saxo complies with Hong Kong’s financial standards, including client fund protection and operational transparency.

In addition to its SFC license, Saxo is supervised by several global Tier-1 regulators, including:

- Danish Financial Supervisory Authority (FSA) – Saxo’s home regulator

- Monetary Authority of Singapore (MAS)

- UK Financial Conduct Authority (FCA)

This multi-layered regulatory framework provides an added layer of safety for capital and ensures Saxo can legally serve cross-border clients.

Instrument Range and Global Market Access

Saxo Bank is known for its unmatched product offering. With a single account, clients in Hong Kong can access over 40,000 instruments across 30+ international markets, including:

- Equities (HKEX, NYSE, LSE, ASX, and more)

- Exchange-Traded Funds (ETFs)

- FX trading in more than 180 currency pairs

- CFDs on stocks, indices, and commodities

- Options and futures on major global exchanges

- Government and corporate bonds

- Structured products and mutual funds

For investors seeking exposure to both local and international markets from one platform, Saxo offers one of the most complete selections available.

Platform Features: SaxoTraderGO & SaxoTraderPRO

Saxo offers two main platforms, each designed to cater to a different level of trader.

SaxoTraderGO is a web-based and mobile platform designed for serious retail and semi-professional traders. It includes:

- tuitive navigation

- Real-time charts

- Live market news from Reuters

- Built-in economic calendar and trading signals

SaxoTraderPRO is a downloadable desktop terminal geared toward professionals and high-frequency users. Features include:

- Advanced order types and algorithmic execution

- Multi-screen support

- Access to liquidity pools for institutional-level pricing

- Custom workspace creation and position management tools

Both platforms offer integration with external charting packages and API access for automation or integration with custom tools.

Account Types, Minimum Deposit, and Fees

Saxo structures its services into three account tiers — Classic, Platinum, and VIP — depending on deposit size and trading activity:

| Account Type | Minimum Deposit | Benefits |

|---|---|---|

| Classic | USD $500 | Standard spreads and full platform access |

| Platinum | USD $200,000 | Reduced commissions, priority support |

| VIP | USD $1,000,000 | Tightest spreads, direct access to analysts |

Commissions vary by asset class and volume. For example:

- HKEX stocks: from 0.08% per trade

- Forex: spreads start from 0.4 pips (Platinum/VIP)

- US stocks: from $0.01 per share

Leverage for professional users can reach:

- Up to 1:50 on FX

- 1:20 on major indices

- Lower leverage on stocks and bonds due to risk classification and SFC regulations

All accounts provide access to institutional-grade risk analytics, position breakdowns, and full transparency on execution pricing.

Market Data and Research Tools

Saxo integrates third-party and proprietary research directly into the trading platform. For clients in Hong Kong, this includes:

- Real-time quotes from HKEX and major international exchanges

- Daily technical reports

- In-house macroeconomic commentary

- Company fundamentals, dividend data, and earnings reports

- Strategy guides and webinars tailored to high-net-worth investors

News is streamed via Dow Jones, Reuters, and regional newswires, making it useful for those who monitor corporate and economic developments closely.

Who Should Use Saxo Bank in Hong Kong?

Saxo is not designed for casual traders or beginners. The platform is optimized for clients who require global access, flexible execution, and advanced tools.

It is best suited for:

- High-net-worth individuals (HNWI)

- Family offices and wealth managers

- Discretionary traders with global portfolios

- Institutional clients without direct market access

- Forex and bond traders who need pricing depth and risk analytics