Although TD Ameritrade is a US-based brokerage firm, it remains one of the top platforms for Hong Kong-based traders who want seamless access to the US financial markets. Known for its powerful Thinkorswim trading platform, extensive educational content, and zero-commission stock trading, TD Ameritrade offers a competitive edge for both new and experienced investors outside the United States.

International Access with a US Brokerage Experience

TD Ameritrade enables residents of Hong Kong to open brokerage accounts with access to NYSE, NASDAQ, and AMEX—the core of the American equity market. Traders can participate in the same stock opportunities available to US citizens, including blue-chip stocks, ETFs, options, and more.

Key Benefits for Hong Kong-Based Traders

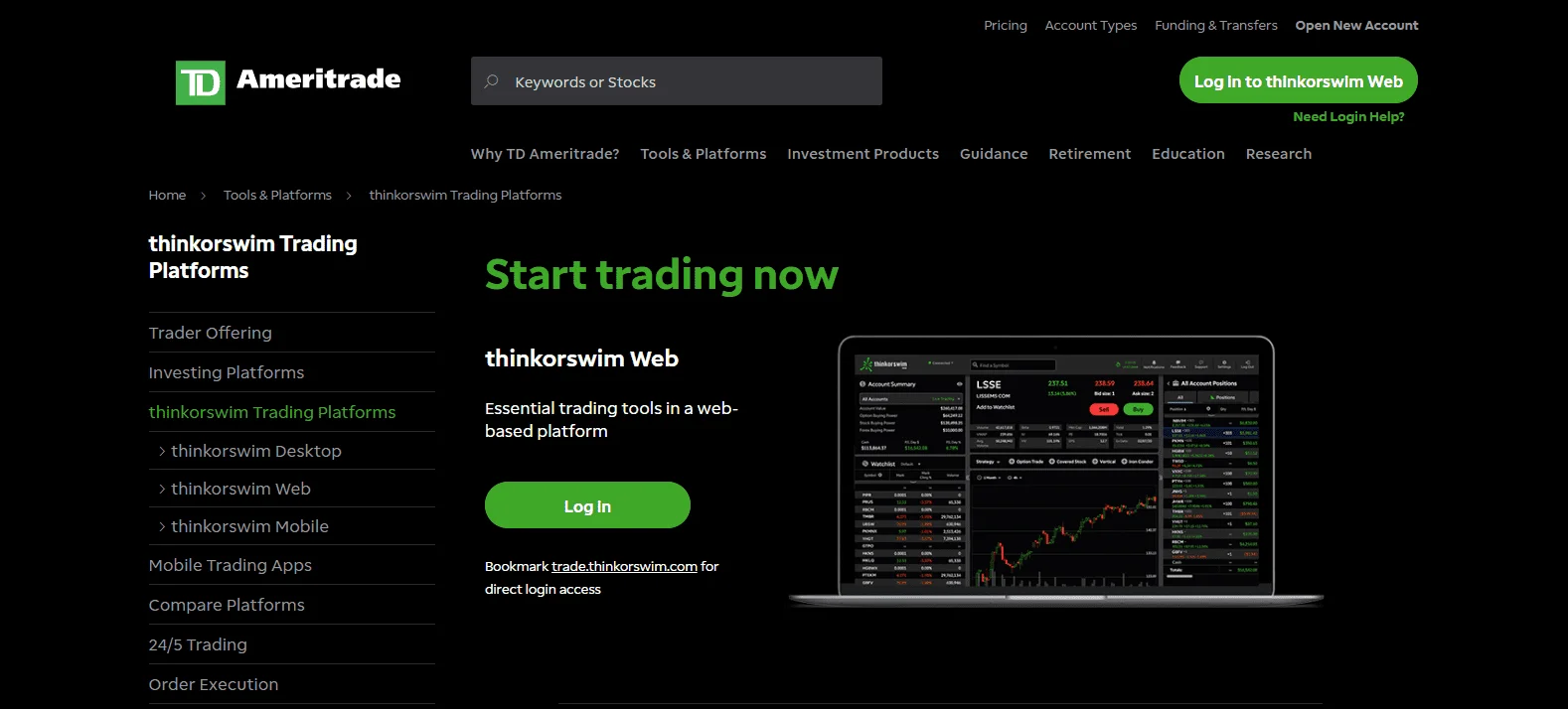

Advanced Trading with Thinkorswim

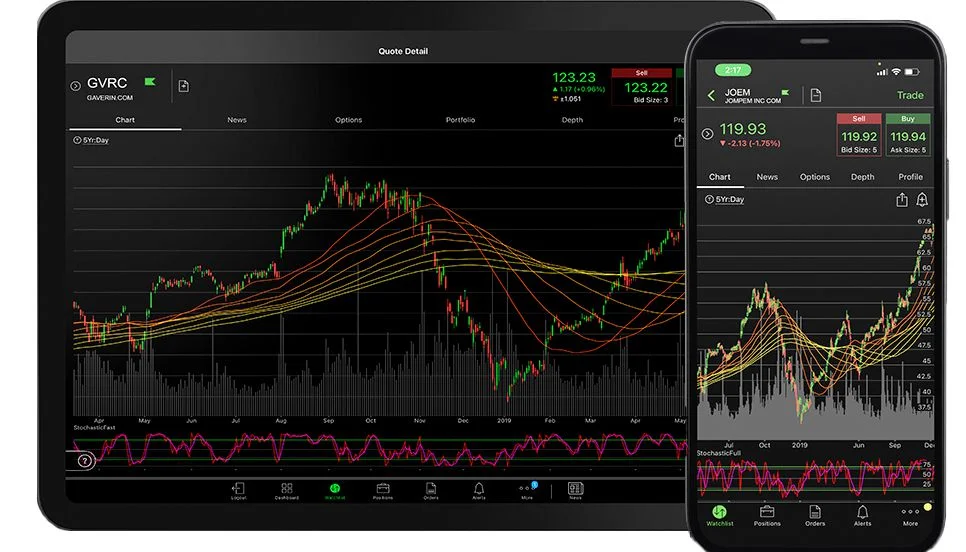

The Thinkorswim platform is one of the most advanced trading tools available to retail traders globally. It includes:

- Real-time streaming quotes

- Customizable charts with hundreds of technical indicators

- Strategy backtesting and paper trading

- Scripting language for custom studies

This makes it ideal for traders who rely on technical analysis and real-time data.

Commission-Free Trading

TD Ameritrade offers $0 commission trades on US-listed stocks and ETFs—saving traders significant costs, especially those with high-volume strategies.

Comprehensive Educational Resources

With access to a massive library of webinars, articles, videos, and interactive courses, traders in Hong Kong can learn everything from basic investing principles to complex trading strategies.

- Covers topics like margin trading, portfolio diversification, options trading, etc.

- Content is regularly updated to reflect changing market dynamics.

No Platform or Inactivity Fees

Unlike many brokers, TD Ameritrade charges no platform usage fees, maintenance fees, or inactivity charges, making it especially attractive to part-time or long-term investors.

Simulated Trading Environment

New traders can use the paperMoney® simulator to practice trading strategies in real market conditions—without risking capital. This is an excellent way to refine techniques before trading live.

Account Funding & Currency Considerations

Hong Kong-based users should be aware that TD Ameritrade accounts are denominated in USD. When transferring funds:

- Use international wire transfers

- Expect currency conversion fees from HKD to USD

- Consider using multi-currency fintech services (e.g., Wise, Revolut) to reduce conversion costs

TD Ameritrade does not charge incoming wire fees, but your bank might.

Taxation and Reporting for Hong Kong Investors

As a non-US resident, Hong Kong traders using TD Ameritrade should understand the US tax implications:

- No capital gains tax for Hong Kong residents trading US stocks

- 30% withholding tax on US dividends, as per IRS rules

- Form W-8BEN is required to certify foreign status and benefit from tax treaty rates (if applicable)

Although Hong Kong has no capital gains tax, it is always best to consult a local tax advisor regarding cross-border investment implications.

Security, Regulation & Trust

TD Ameritrade is:

- Regulated by the U.S. Securities and Exchange Commission (SEC) and Financial Industry Regulatory Authority (FINRA)

- Member of SIPC: Clients are insured up to $500,000 (including $250,000 for cash claims)

- Uses advanced encryption, 2FA, and real-time fraud monitoring

For Hong Kong investors concerned with fund safety and data protection, TD Ameritrade provides robust regulatory and technical safeguards.