TradeStation Global is a powerful trading solution that integrates TradeStation’s award-winning charting and analysis tools with the global execution network of Interactive Brokers (IBKR). This hybrid platform is particularly beneficial for professional traders, quantitative analysts, and system developers in Hong Kong who require deep functionality for strategy design, testing, and deployment across global markets.

Why It Matters for Hong Kong-Based Traders

Hong Kong’s financial markets are highly interconnected with international exchanges, making global access and efficient execution critical for local traders. TradeStation Global offers a strong proposition by delivering:

- Reduced technology overhead – algorithmic traders get advanced tools without the need to build a backtesting or execution engine from scratch.

- Access to global markets through IBKR – including equities, futures, options, and forex from the US, Europe, and Asia.

- Localized advantage – traders in Hong Kong can manage strategies across multiple time zones with low latency and institutional-grade infrastructure.

Seamless Interactive Brokers Integration

TradeStation Global operates on top of an Interactive Brokers account, meaning users gain:

- Direct market access (DMA) to over 100 global exchanges

- Low commission structure across asset classes

- Tiered margin benefits and efficient order routing

This makes it ideal for Hong Kong-based traders executing across different markets, including NYSE, NASDAQ, LSE, and Tokyo Stock Exchange.

Custom Scripting via EasyLanguage

For algorithmic and system traders, EasyLanguage remains a standout feature:

- A proprietary, English-like scripting language for coding custom indicators, alerts, and strategies

- Supports real-time and historical data analysis

- Enables walk-forward optimization, multi-system portfolios, and event-driven logic

Hong Kong algo developers can leverage EasyLanguage to build strategies tailored to specific volatility patterns in both Asian and Western markets.

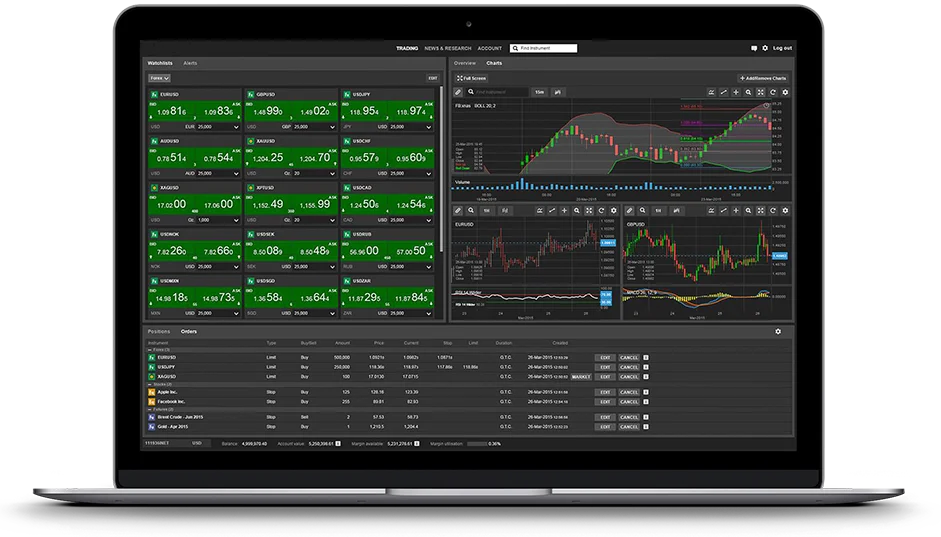

Deep Technical Analysis Tools

TradeStation is renowned for its charting and analytical capabilities, which include:

- More than 100 built-in indicators and drawing tools

- Customizable multi-timeframe charts

- Market scanner and RadarScreen™ to track real-time conditions across hundreds of symbols

This allows local traders to maintain watchlists spanning HKEX-listed stocks, US tech, European indices, and forex pairs in a unified workspace.

Advanced Backtesting Environment

Backtesting is a critical feature for validating trading models, and TradeStation Global offers:

- Tick-by-tick historical data simulation

- Monte Carlo analysis and slippage modeling

- Strategy performance metrics (Sharpe, max drawdown, expectancy)

It gives Hong Kong system traders a quant-level testing suite to reduce live-trading risks.

Competitive Fee Model

The cost structure of TradeStation Global is aligned with active traders:

- Zero platform fees (when minimum trading activity or asset value is maintained)

- Low commissions via IBKR (e.g., US stocks from $0.0035/share)

- No data fees for TradeStation’s analytics, and optional market data subscriptions via IBKR

This is particularly appealing for Hong Kong traders seeking cost efficiency without sacrificing depth or execution quality.

Who Should Use TradeStation Global?

This platform is highly recommended for:

- Systematic Traders – who need a robust infrastructure for modeling, testing, and deploying algorithmic strategies across markets.

- Technical Analysts – seeking high-resolution charts, predictive indicators, and integrated scanning tools.

- Algo Developers – who require custom scripting and execution flexibility in a trusted environment.