Tiger Brokers is a leading online brokerage designed for cross-border investors who require efficient access to China, Hong Kong, and U.S. markets from a single account. Regulated by the Securities and Futures Commission (SFC) in Hong Kong, the broker combines advanced technology, transparent pricing, and comprehensive market data integration.

Regulatory Oversight and Security

Operating under the SFC’s supervision ensures Tiger Brokers meets strict capital, reporting, and investor protection standards. Client funds are held in segregated accounts, and the firm employs multi-layered cybersecurity measures to protect data and transactions. For Hong Kong traders, this provides reassurance that their capital and trading activities are managed within a strong regulatory framework.

Market Access and Trading Instruments

Tiger Brokers offers access to multiple exchanges, including:

- Hong Kong Stock Exchange (HKEX)

- Shanghai and Shenzhen Stock Connect

- NASDAQ and NYSE

This cross-border reach allows users to diversify across Asian and U.S. equities, ETFs, and options, all from a unified interface. Margin trading and short-selling features are available for experienced traders seeking leveraged exposure.

Key Advantages

- Multi-market, Multi-currency Account: Traders can hold and convert between HKD, USD, and CNY within the same account. This flexibility simplifies portfolio management for those operating across regional markets and currencies.

- Options and Margin Trading: The broker supports advanced strategies such as options spreads, covered calls, and margin-based positions. Real-time risk metrics and collateral management tools help traders maintain leverage responsibly.

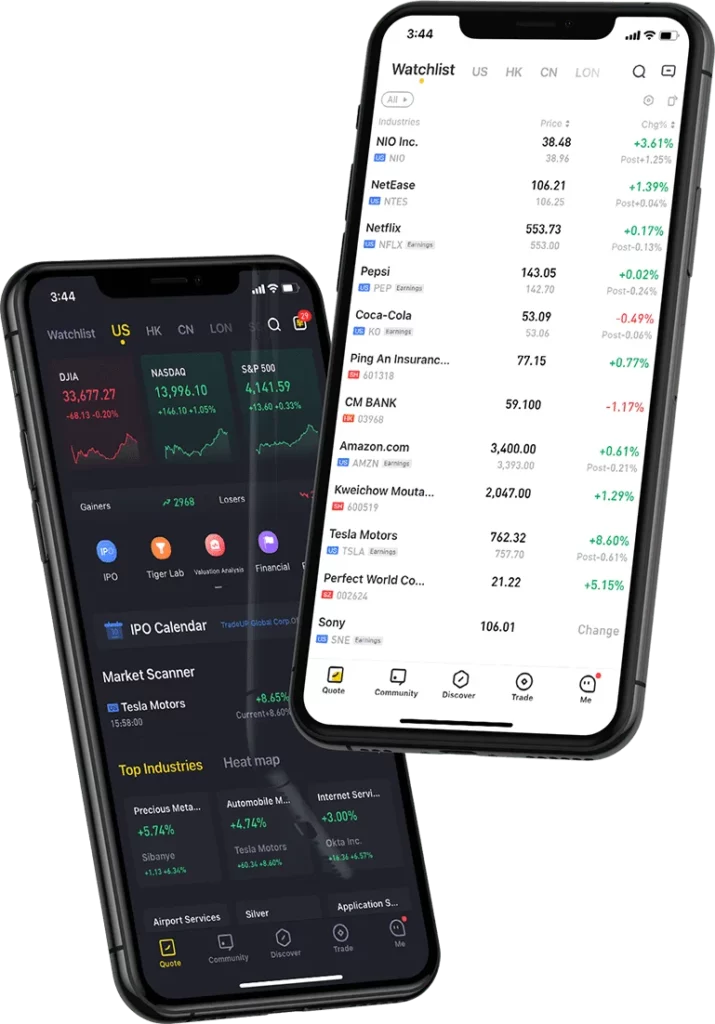

- Platform Accessibility: Tiger Brokers provides both desktop (Tiger Trade) and mobile apps, offering synchronized account management and order execution. The mobile interface includes market heat maps, watchlists, and customizable alerts, appealing to active traders.

- Detailed P&L Tracking and Analytics: The platform includes automated performance tracking, enabling traders to review profit/loss by asset, time period, or strategy. Detailed analytics assist in refining investment decisions and identifying risk exposure trends.

Fees and Execution Quality

Tiger Brokers maintains competitive commission rates with transparent fee structures. It also provides access to Level 2 market data, ensuring faster order routing and visibility into liquidity depth. Execution efficiency is a core advantage for intraday traders focusing on U.S. and Hong Kong stocks.

Best For

Tiger Brokers is best suited for:

- Cross-border investors managing positions in China, Hong Kong, and U.S. markets

- Active traders using margin or derivatives

- Professionals seeking high-quality market data and customizable analytics